SeeTek®

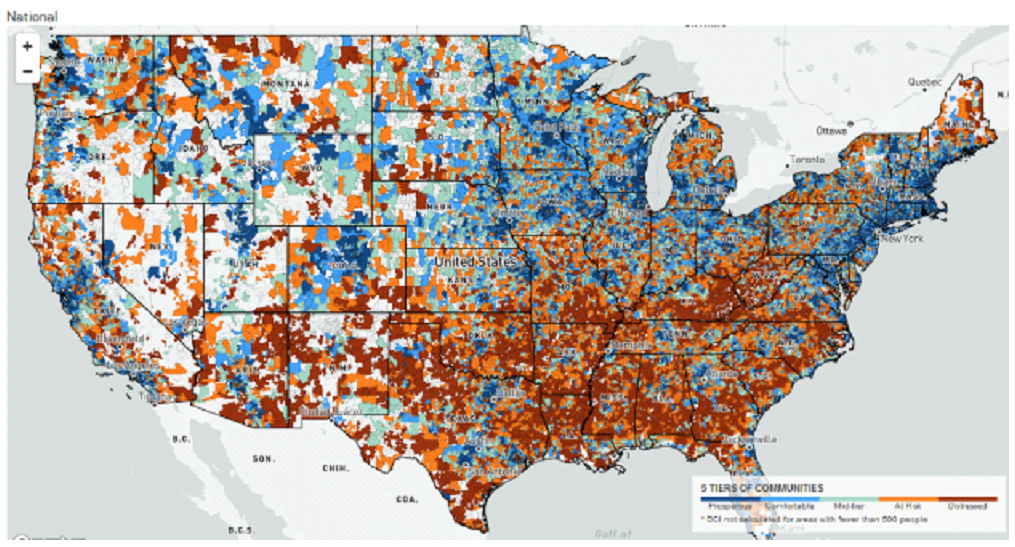

Solving the Growing "Bank Desert" Challenge Across America.

This is where 164 Million Bank Challenged™ people live!

WHY CHOOSE SeeTek®

Instant Issue Bank Accounts

Instant On Boarding of NEW Clients

Instant AI OCR Forensic KYC Disciplines

Instant Pro-Active ID & Check Fraud Controls

Instant Access to Broader Regions Thru Our Merchant Partner Programs

Meet & Exceed Financial Institutions Requirements to Expand Footprint and Gain Market Share!

Envision Your Financial Future

Contact SeeTek today!