SeeTek OuterBanx® Mini Bank Branches

Solve Bank Deserts Across America!

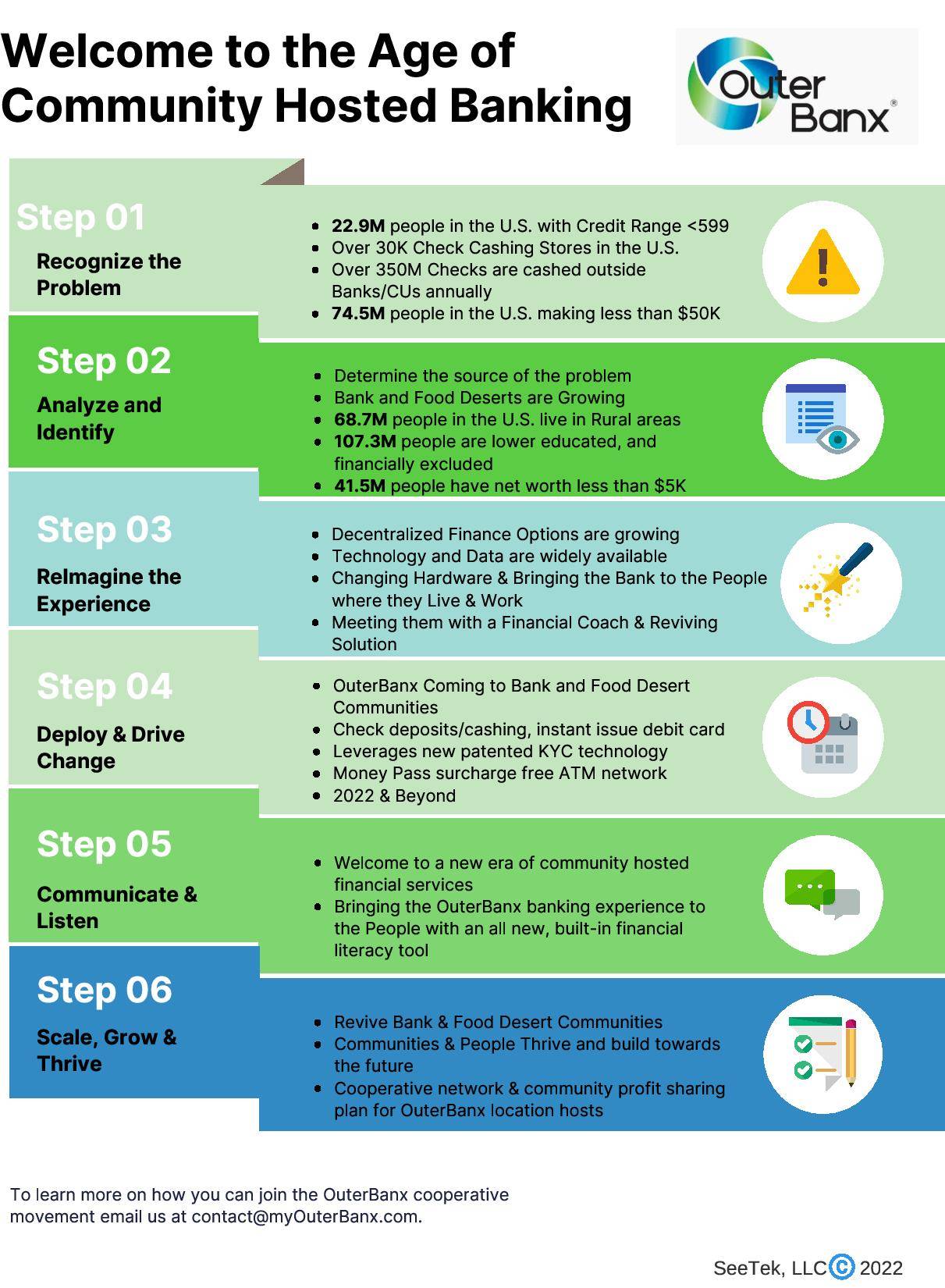

Welcome to the Age of Community Hosted Banking

Recognize the Problem

- 22.9M people in the U.S. with Credit Range <599

- Over 30K Check Cashing Stores in the U.S.

- Over 350M Checks are cashed outside Banks/CUs annually

- 74.5M people in the U.S. making less than $50K

Analyze and Identify

- Determine the source of the problem

- Bank and Food Deserts are Growing

- 68.7M people in the U.S. live in Rural areas

- 107.3M people are lower educated, and financially excluded

- 41.5M people have net worth less than $5K

ReImagine the Experience

- Decentralized Finance Options are growing

- Technology and Data are widely available

- Changing Hardware & Bringing the Bank to the People where they Live & Work

- Meeting them with a Financial Coach & Reviving Solution

Deploy & Drive Change

- OuterBanx Coming to Bank and Food Desert Communities

- Check deposits/cashing, instant issue debit card

- Leverages new patented KYC technology

- Money Pass surcharge free ATM network

- 2022 & Beyond

Communicate & Listen

- Welcome to a new era of community hosted financial services

- Bringing the OuterBanx banking experience to the People with an all new, built-in financial literacy tool

Scale, Grow & Thrive

- Revive Bank & Food Desert Communities

- Communities & People Thrive and build towards the future

- Cooperative network & community profit sharing plan for OuterBanx location hosts

#cbsiTalkingBusiness, e-Magazine

April 14, 2022 Early Spring Edition

Kevin Kerridge CEO of Orlando, Florida based SeeTek joined us to discuss serving unbanked and underbanked areas and groups and explained "Bank Deserts"

"You would think half the country is covered by "Bank Deserts", Vermont, Hawaii, any major city has a bank desert challenge"

Kevin presented the #OuterBanx program which provides advanced ATM type machines which in three minutes can open an account, verify ID, accept deposits and provide funds access via debit cards.

Thanks Ken Kraetzer at CBSI Talking Business for the interview

Introducing the bank branch of the future AND Banking for EVERYONE!

Still swapping around bankable customers among banks while leaving everyone else disenfranchised?

A new untapped market 150 million Bank Challenged people awaits...

81 million of them, Millennial’s who shun traditional banking... and will pay for convenience and speed. SWORD® Technology= Efficient, Agile, Innovative/Vision, High Tech, Digital with Execution thru Bank & Retail Partners for Strategic, Fast Distribution!

What You Get!

The ATM class SeeTek® OuterBanx® On Boarding Terminal with Instant Issue Bank Account & Debit Card!

Fractional cost to acquire a new customer in LESS THAN 5 minutes vs $350 in branch and 45 minutes!

Fractional Branch footprint WITHOUT legacy costs vs $3mm Branch build out WITH legacy costs!

Satisfies the banks “wish list” for branch of the future!

Provides basic banking to a NEW UNTAPPED market of 150 million “Bank Challenged” American’s.

Patented SWORD® Technology incorporating Optical Character Recognition Artificial Intelligence (AI).

Full Pro-Active forensic vetting process of person, ID and Check Pro-Actively before the fraud enters your systems!

Full compliance meets and exceeds all US Treasury, FDIC, CFPB rules and regulations.

Globally proven Back Office platform certified on VISA, MC, AMEX, Discover and Star networks.

Find out what the bank industry experts are talking about...

What is the SeeTek® OuterBanx® Terminal?

The secure “Known Trusted Gate Keeper” to the bank!

And the key to efficient operations in the field.

SWORD® Pro-Actively eliminates ID and Check Fraud at the “Point of Entry” before the account is set up and deposited checks are processed thus reducing waste and legal costs, all of which costs your bank time and money.

The SeeTek® Terminal is classified as an ATM but it is not self serve and does not deliver cash notes.

Cash is available from any of the almost 34,000 Money Pass Surcharge FREE ATM’s across America!

[Money Pass ATM included with Deposit & GO InstaDebit Mini Bank Branch Program]

SWORD® Checkless Checking Bank Account ™

Why not offer a basic bank product that works for the people

What is an affordable vehicle to an automotive manufacturer

Answer: entry level products!

What is OuterBanx®?

Entry level banking...

LESS THAN 5 minutes one time enrollment.

LESS THAN $15 cost to the bank.

Full “forensic Pro-Active KYC” on person, ID and payroll Check.

NO Credit check required!

No checks issued, no NSF fees, no OD fees, no credit cards, no complex paperwork, no confusion

= NO PROBLEMS & LOW COSTS!

Customer Service

Years of research and development collected from many third party sources as well as our own “man on the street” R&D revealed that the customer wanted, what else?

Customer Service.

The result is a hybrid operator (Teller/Cashier) and customer experience.

Confidential information is scanned into the terminal quickly and efficiently WITHOUT any key strokes while the operator has an opportunity to establish a relationship with the customer keeping Customer Service strong.

A Happy Customer is a Loyal Customer.

A Happy Customer is your greatest ally and referral business is the most cost effective advertising known to man!

Why a “OuterBanx® Mini Bank Branch” and why now?

Businesses must evolve or become obsolete. Such is the case with traditional bank branches.

Check cashers and Pay Day Loan businesses know these 3 KEY business practices:

- Location, go to the people

- Customer Service, smile at the people

- Products, that are easy to understand for the people

RESULT: FiSCA has grown at a whopping 30% since 2000.

To make matters worse... according to a recent study by Accenture

“Banks will lose 35% of their market share to retail solutions such as Google, Amazon and otherFinTech’s by 2020”

And

“consolidation will continue to play out between now and 2020, by which point we estimate that 15 to 25 percent of today’s roughly 7,000 North American financial institutions could be gone.”

Bank Deserts

The growth of Bank Deserts have accelerated across America due to the closures of non performing expensive full service bank branches. Since 2008, 93% of these non performing branch closures have been in low to mid income neighborhoods.

WSJ Reports that 1700 branches closed in 2016. The largest amount since the Great Depression.

See Bank Deserts here!......

Think outside the box!

And in the process, build your brand by increasing your banks footprint and customer base!

SeeTek® OuterBanx® Mini Bank Branches

Location, location, location... placement is key ...

SWORD® OuterBanx® are an entry level bank branch delivering basic products where the prospects live and shop!

The SeeTek® OuterBanx® Mini Bank Branch with its small POS size footprint, may be located in any existing retail operation (Grocery, Rent To Own, etc) or our Mall Kiosk Program, OuterBanx®.

Retail or Bank Installations

The OuterBanx® Retail installation prints an “instant issue” Photo ID Debit Card, used anywhere you see the STAR network logo.

Retail POS, Gas Pumps, 40,000 Surcharge FREE Money Pass ATM’s, etc...

Up sell a VISA or MC “companion card” printed at FI’s card printer and mailed. hologram stock!

With a full Online Banking Suite providing financial products designed for the Bank Challenged!

Money Remit, Bill Pay, SWORD Virtual Checking, eGift Cards, Prepaid Long Distance, Cell Phone Top Up and eGift Cards to name a few!

Build a community financial network with an efficient and cost effective delivery network.

Take the Bank Desert Challenge!

Certified for VISA, MC, AMEX, Discover and STAR networks.

The high tech proprietary terminal is registered:

- USPTO

- US, CDN governments & NATO

- Dept of Homeland Security (DHS)/FEMA

- US/CDN Joint Certification Office Defense Logistics Information Service

Thank you for your interest in OuterBanx® and the DebitBankAccount "checkless checking account".