Fast Facts

The entire underserved population comprises more than a quarter of all U.S. households — some 68 million adults.

(Official US government figures)

However, other US government studies show 150 million Americans are considered unbanked or underbanked

(FDIC Study Oct 2014)

(NOTE: 2000 Federal Reserve Bank study = 43 million. 2008 VISA study = 108 million)

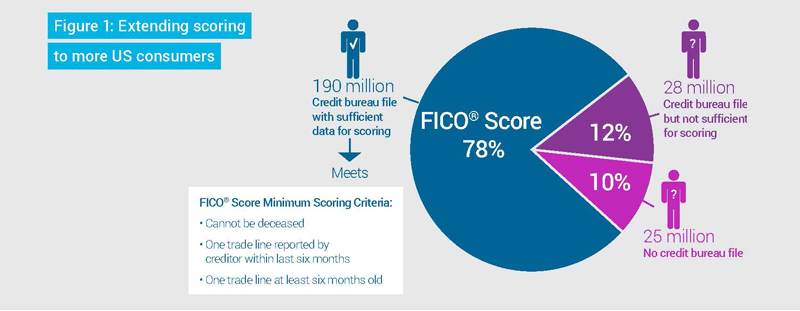

53 million people without a FICO credit score. 28 million consumers have files with insufficient data to meet these criteria. And more than 25 million consumers have no bureau file at all.

These two unscorable populations include many creditworthy individuals — people many financial institutions would welcome as customers.

[SWORD Tech gives you access to these people and many more. PLUS a management system to manage these people the banks consider non traditional non FICO score bearing consumers.]

From the FICO Decisions paper, Can Alternative Data Expand Credit Access?

“Bank Challenged” (unbanked / underbanked) Americans spend as much money on financial services as they do on food or roughly 10% of their income about $2500 - $4500/year.

(FDIC Study Oct '14)

An unbanked worker can spend $41,600 over a lifetime in check-cashing fees, the Brookings Institution, a liberal think tank, estimated in 2008.

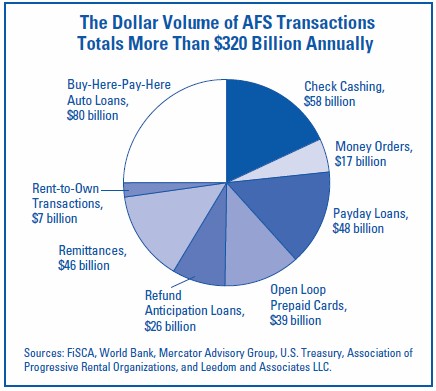

In 2012, they (unbanked / underbanked) spent about $89 billion just on interest and fees for alternative financial services.

(AFS or Alternative Financial Services are defined as prepaid cards, check cashers, pawnshops etc)

In 2014, Financial Service Centers of America (FiSCA) estimates that non-bank financial transactions at outlets such as these account for $106 billion (over 350 million transactions) annually, and check-cashing services are responsible for over half of the industry's activity.

Check-cashing outlets are big business in the financial industry, with numbers on par with banks and credit unions. FiSCA counts about 13,000 outlets (FSCs) in the United States, 30% higher than economist John P. Caskey's tally of 10,000 using the Yellow Pages in 2000.

(Note: FiSCA is only one of several check cashing associations plus the many independents)

However, a 2009 FDIC Study shows the total dollar volume of Alternative Financial Services to be $320 billion (including fees, interest and penalties). The article further states, that figure is likely understated because it reflects only formally recorded transactions.(Now here we are going on eight years later...)

Since 2008, 93% of bank branch closings have been in zip codes with below-national median household income levels. Meanwhile, banks have been opening branches in areas with median incomes above $100,000.

(Source: The Pew Charitable Trusts)

A new term has been coined for these vast areas without any bank branches, "bank deserts".

Deposit & GO InstaDebit® terminal(s) partnered with a Bank or Credit Union and installed at your local grocery store, c-store, auto dealer, mall or other locations would end the spread of "bank deserts" and slow the growth of check cashers filling the void.

Enough said. The "fix" is obvious!

America needs a new basic bank product and secure national delivery system!